A tough road ahead for the UK economy 🇬🇧

The UK is facing a growing economic squeeze. Debt stood at £2.8 trillion for March 2025, nearly 96% of GDP, and interest payments alone are set to hit £104.9 billion this year, averaging a cost of 3.75%. By contrast, the UK’s GDP increased by just 0.9% in 2024, well below this average cost.

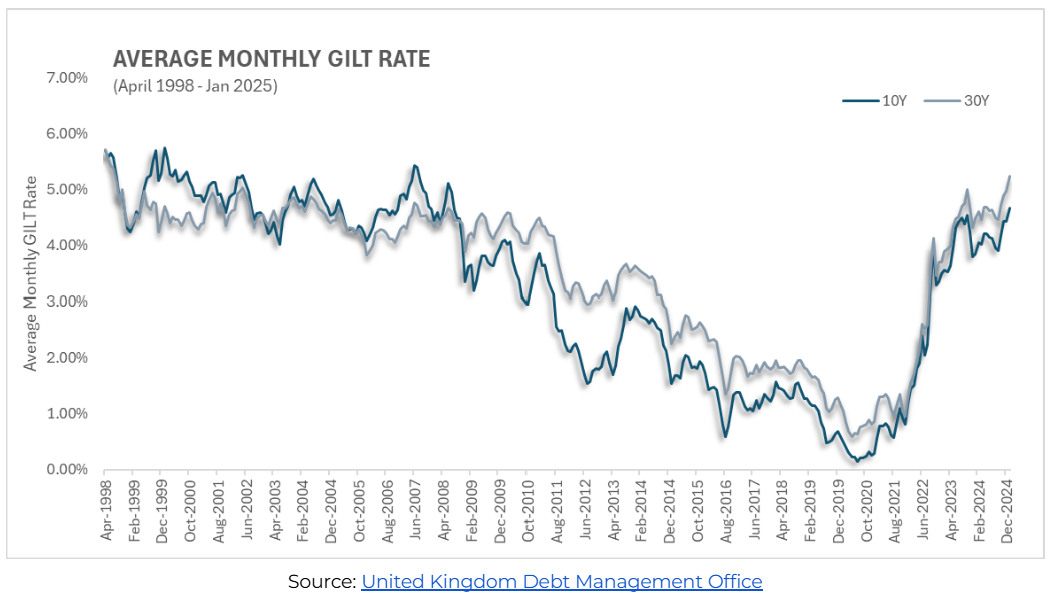

In her recent Spring Budget, Chancellor Rachel Reeves confirmed further welfare cuts, reduced departmental budgets, and a boost to defence spending — all while grappling with a £22 billion deficit. The Office for Budget Responsibility (OBR) has halved its growth forecast from 2% to 1%. Furthermore, earlier this week, we learned that the UK’s yearly borrowing to the end of March has actually exceeded the OBR’s forecast by roughly £15bn. Although we saw a sustained reduction of the UK 10y and 30y GILT rate from 1998 to 2020, we have seen a dramatic escalation since. As reported in Stratibites earlier in April, the 30-year UK GILT recently crossed a multi-decade high, reaching levels not seen since 1998. This means we are facing a simultaneous challenge of higher debt and higher debt costs.

Average monthly gilt rate

The reality? The UK has run a deficit nearly every year since 1993, with spending outpacing income. Debt levels surged during the 2008 crisis and again during COVID, and have not meaningfully come down since.

The options?

- Raise taxes → Unpopular

- Cut spending → Austerity 2.0

- Borrow more → Which increases the debt burden further

Without meaningful growth, even standing still becomes more expensive.

While fiscal tightening and sluggish growth paint a tough short-term picture, these are also the moments that tend to catalyse the next wave of opportunity. In times of uncertainty, investors often become more intentional, shifting from speculative trends to sustainable value.

What this means for your investment strategy

Rising costs and mounting debt, combined with a persistent budget deficit, have the potential to contribute to higher inflation and further devaluation of the GBP. Under these conditions it is important to have a diversified approach for your investments in order to mitigate these risks. Certain sectors are a natural inflation hedge, and dividend paying stocks also add a degree of protection.

You can test your own strategy today with Stratiphy, run a 10 year historical simulation, and invest into it in our mobile app.

Stay informed with us — follow for regular insights on how market shifts could impact your financial future.