Strategy Performance Update

We are now managing hundreds of strategies for individual investors. Each one has been backtested and curated carefully by its owner.

To understand how they are performing, we've analysed results across the board and compiled this overview for you.

Performance figures are based on actual client strategies. Past performance does not guarantee future returns. Market conditions change and future performance may differ significantly.

Overall Performance

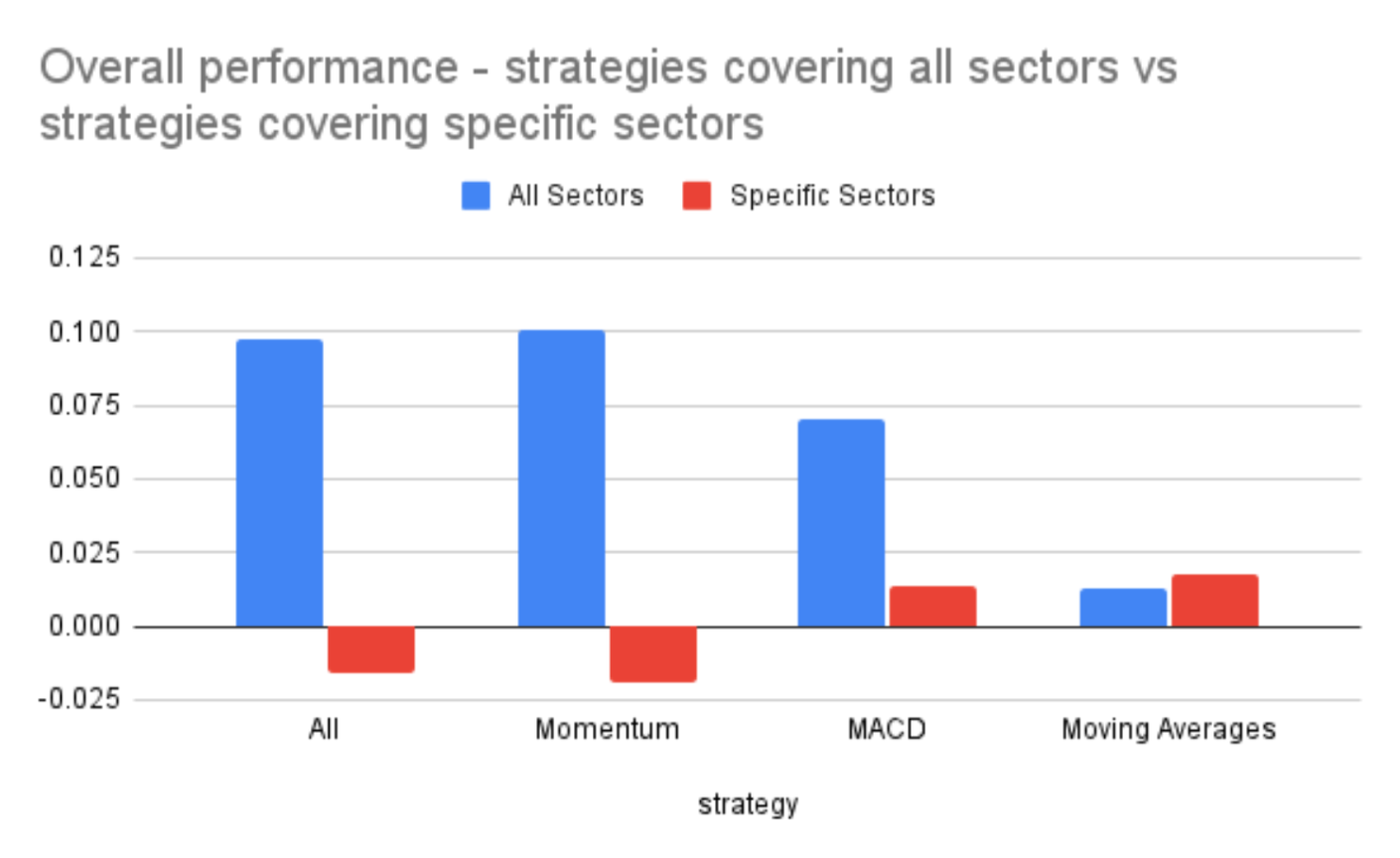

Here’s a breakdown of average performance by each strategy type:

Momentum: +16.17%

This strategy invests in stocks that are already trending upward. The idea is straightforward: assets that are rising tend to continue rising until the trend reverses.

MACD: +10.96%

MACD stands for Moving Average Convergence Divergence. It uses changes in price trends to spot moments when a stock may be turning up or down. This helps capture opportunities during market shifts while keeping risk controlled.

Moving Averages: +5.55%

This strategy smooths out day-to-day market noise by tracking longer-term price trends. It aims to stay steady through volatility and avoid reacting to short-term fluctuations.

And taking all strategies together on the Stratiphy platform - the average performance stands at +15.37%

Almost 7 out of 10 strategies performed within the range -2.5% to 33%. By way of comparison, the FTSE100 returned 5.56% over the last 5 months (the average duration of all our strategies).

Impact of Filtering by Sectors

Interestingly we found that filtering by a subset of sectors generally reduced the performance, however there was a slight increase for Moving Averages strategies.

Deeper Insights: MACD & Momentum Continue to Outperform

Let’s take a deeper dive into these results:

Momentum Strategies

- Standard deviation: 18.36%

- Sharpe ratio: 0.64

- Sortino ratio: 1.65

This standard deviation means that almost 70% of these strategies had a performance within the range -2.19% to 34.53%. This strategy type has the highest dispersion.

This Sharpe ratio means that for every unit of risk taken, the strategy delivered almost 0.64 units of positive performance, showing a healthy risk-adjusted return.

This Sortino ratio means that for every unit of downside risk taken above the risk-free rate, the strategy delivered 1.65 units of positive performance, showing a strong downside-risk adjusted performance. Many investors prefer this measure of efficacy relative to the Sharpe ratio because they consider that downside risk is the only risk that really matters.

MACD Strategies

- Standard deviation: 13.71%

- Sharpe ratio: 0.48

This Sharpe ratio means that for every unit of risk taken, the strategy delivered almost 0.48 units of positive performance, showing a healthy risk-adjusted return.

This standard deviation means that almost 70% of these strategies had a performance within the range -2.75% to 24.67%.

Moving Averages Strategies

- Standard deviation: 3.72%

- Sharpe ratio: 0.31

This Sharpe Ratio means that for every unit of risk taken, the strategy delivered 0.31 units of positive performance, showing a positive risk-adjusted return.

This standard deviation means that almost 70% of these strategies had a performance within the range 1.82% to 9.72%. This is the most consistent performance across all of our strategy types.

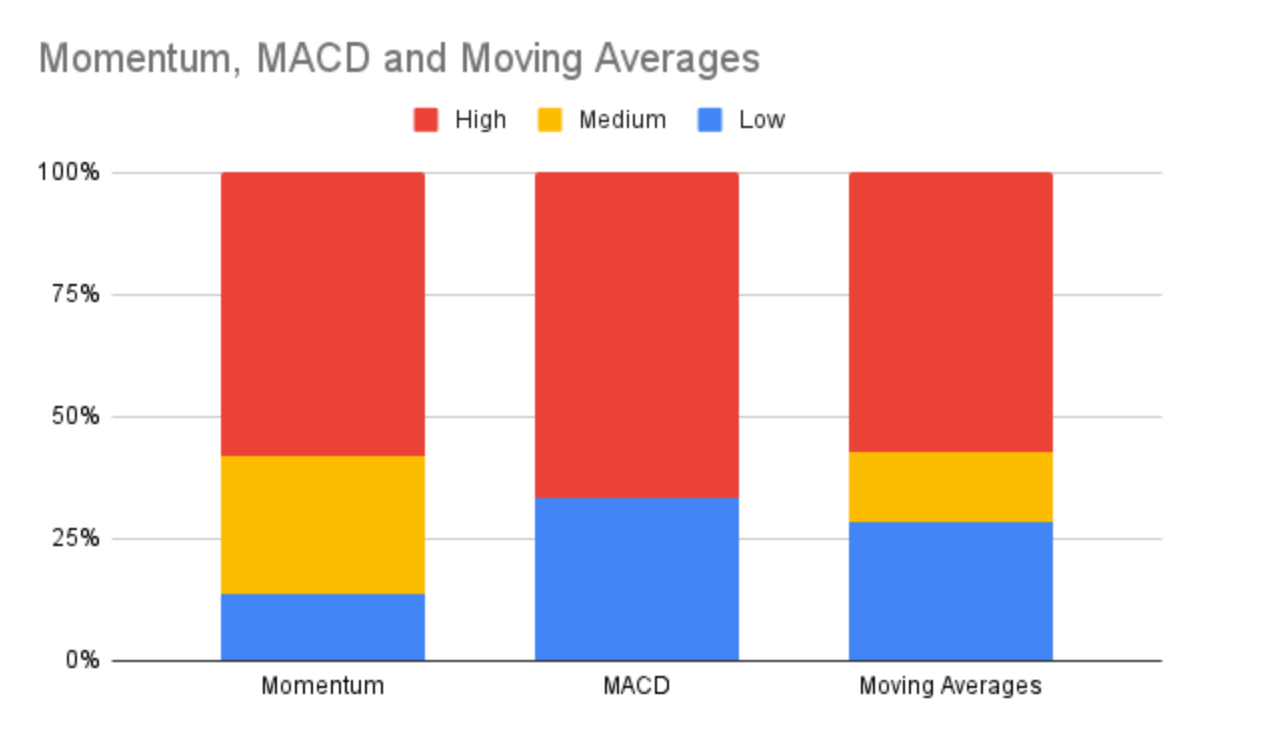

Which Strategies Are People Creating

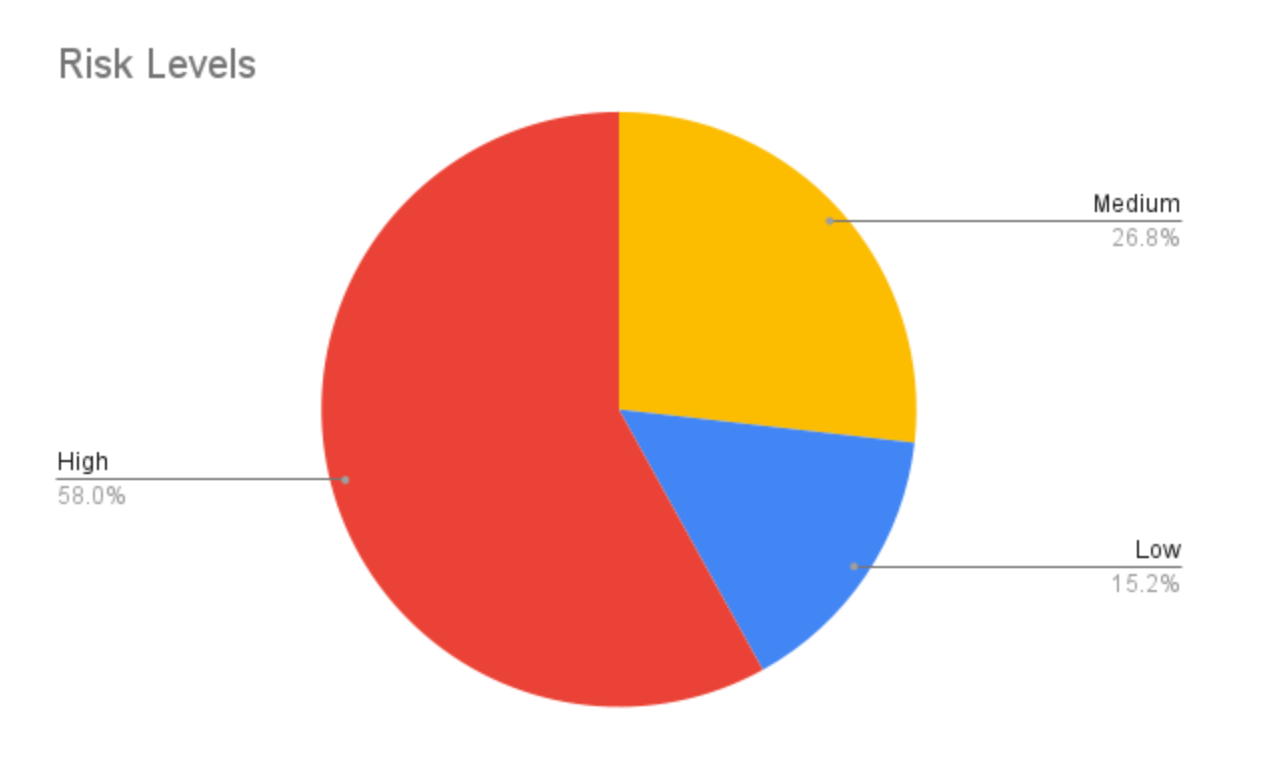

The most popular risk setting for users was “high risk” across all strategy types.

..and aggregated across all strategies:

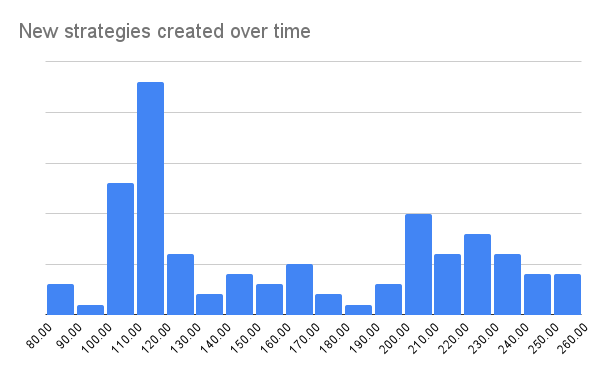

We saw a big spike in new strategies created when we launched, and then a steady stream of new strategies added to the platform over time.

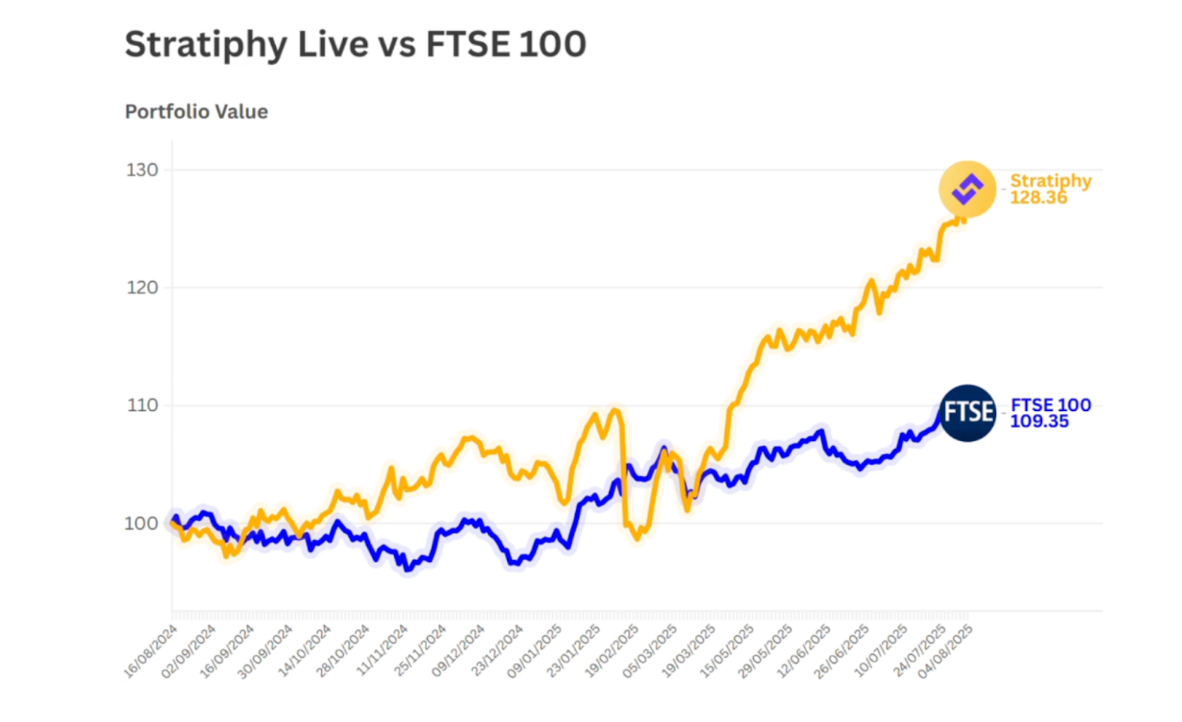

🐇 Spotlight on “Emerald Rabbit”: Our First Live Trading Strategy

Launched in August 2024, Emerald Rabbit has been running over a year now (almost 14 months) and made through the ups and downs including the Tariff Wars earlier this year, and has manages to deliver exceptional performance:

- +40% total return

- Outperformed the FTSE 100 by +21% over the same period

- Only ~2 trades per month, keeping activity efficient

- 97% invested, remaining fully engaged in the market

This strategy focuses on large-cap UK companies and shows how strategic, rules-based investing can deliver consistent returns even in challenging conditions.

💡 What This Means for Stratiphy

These results highlight how Stratiphy’s technology helps investors build smart, data-driven and personalised portfolios that can balance strong performance with controlled risk.

We are building the future of investing, you can help us deliver more and better features by investing in us and being part of our exciting journey. This raise is closing tomorrow, so today is the last chance - find out more here.

Technical Definitions:

Standard Deviation: Measures how much returns vary over time from their average.

- Low = smoother, more stable performance

- High = more volatility (bigger ups and downs)

Sharpe Ratio: Measures how much return you get per unit of risk taken.

- Higher = better risk-adjusted performance

This is calculated as the excess performance above the risk free rate, divided by the volatility of the portfolio.

Sortino Ratio: Similar to Sharpe, but only looks at downside risk (bad volatility). This was only calculated for Momentum strategies due to data availability.

- Higher = better protection against losses while still delivering returns

This is calculated as the excess performance above the risk free rate, divided by the volatility of negative performance of the portfolio.

Performance

The figures presented in this synopsis represent the average cumulative return of all the strategies in each group. The total return is this is given by the formula:

Cumulative Return = (1 + Annualised Return) ^ (Number of Years) - 1This is calculated for the total time each strategy has been running.

Performance figures are gross of all fees.

The information in this email is not personal financial advice. If you are unsure whether this investment is suitable for your individual circumstances, we recommend you speak to an independent financial adviser.